This article introduces introduces interest-rate options,or Swaptions, and provides a pricing spreadsheet. They are popular with institutions that have cash-flow requirements which are affected by interest rates.

Mean-Variance Optimization with Transaction Costs

This Excel spreadsheet demonstrates the classic mean-variance approach for portfolio optimization, but includes the added complication of transaction costs.

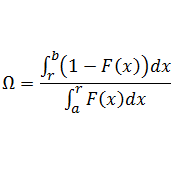

Modified Omega Ratio Favors Rewarding Asset Behavior

The Omega Ratio can be modified so that it favors return distributions that are skewed to the right with a positive mean, and an exponentially decreasing left-tail. This penalizes dangerous asset behavior which can potentially exist as an edge case.