Investors have a dazzling array of mutual funds to pick from. How can investors decide which fund to invest in?

Fund providers usually supply data sheets with historical returns over one year, five years, or more. Relying on these figures alone, however, is often misleading. Rather than simply choosing the fund with the highest return, more savvy investors also use more sophisticated risk-adjusted benchmarks. That’s because higher returns often come hand in hand with greater risk

These are some of the more common performance benchmarks. Click the titles for more detail and a Excel spreadsheet for each benchmark.

Sharpe Ratio

One of the most common performance benchmarks is the Sharpe Ratio. This gives the effective return per unit risk, and is defined by the following equation

The expected return is usually the arithmetic average of the historical returns, and the risk free rate is simply the interest rate you would get from an investment with no probability of loss, like US Treasury Bills.

Standard deviation describes how spread out the returns are from the average, and is often called the total risk (as it takes into account the variation due to the choices made by the individual fund manager, and the risk inherent due to the wider economy). A higher standard deviation means that the returns have a greater variation. It’s important to understand that standard deviation does not quantify the probability of making a loss but simply describes the variability of returns.

Standard deviation as a proxy for risk has a couple of drawbacks. It treats both upside and downside variation equally. Most investors, however, don’t mind upside variation – in fact, they want to encourage upside volatility, but minimize downside volatility

Additionally, the standard deviation assumes that the returns are normally distributed – in other words, they’re the classic bell curve. This is not always the case – investments often have “fat tails”. These are potential gains or losses to the left and right of the normal distribution.

Sortino Ratio

The Sortino Ratio has a definition similar to that of the Sharpe Ratio, but with one important difference. You divide by the downside deviation instead of the standard deviation (this only uses variation below the threshold to quantify risk). This gives us the return per unit downside risk.

Investments that try to minimize downside volatility or maintain a minimum expected return often emphasize their Sortino Ratio.

Since most investors would prefer upside volatility to downside volatility, the Sortino Ratio is considered to better model their risk preference as than the Sharpe Ratio

Alpha and Beta

Alpha quantifies the skill of a fund manager in stock picking and is independent of the general movement of the stock market.

Beta measures the behaviour of stock in relation to the market. Specifically, beta is the sensitivity of a stock to the movements of the entire market. A beta-neutral stock is said to be insensitive to market swings.

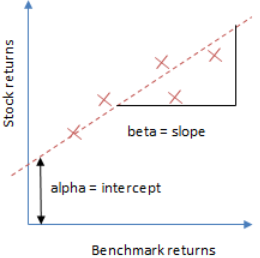

Alpha and beta are easily calculated from a regression analysis. Simply pick your stock and a representative benchmark index (such as the FTSE or S&P500), plot the returns against each other on a plot, and fit a straight line to the data.

Alpha is the intercept on the y-axis, while beta is the slope of the line.

Alpha is the intercept on the y-axis, while beta is the slope of the line.

The value of alpha depends on the time span over which it is measured, but beta is invariant with time. Stocks or funds with high beta vary significantly when the wider market swings. However, high values of alpha act as a buffer to downward market movements.

Essentially, alpha measures performance and beta measures risk. For example, a beta higher than one but with negative alpha indicates a badly managed fund – extra risk is being taken, but with worse performance than the index.

Investors often describe themselves as alpha or beta investors. Alpha investors try to beat the index every year through superior stock selection. Beta investors, however, do not think that that the index can be outperformed in the long term, and are satisfied to have portfolios that rise and fall with the index.

Treynor Ratio

The Treynor Ratio is equal to the effective return of the investment divided by its beta.

The beta described how closely the volatility of the investment correlates to the volatility of the wider market, with the market usually being represented by an index like the S&P500 or FTSE. A higher beta means that the investment is more volatile than the index.

The Treynor Ratio is essentially the effective return per unit of market risk, with a high value indicating a more risk-effective investment.

The Treynor Ratio should only be used on a well-diversified portfolio because diversifiable risk is not considered.

The Sharpe Ratio is a better choice for judging the risk efficiency of mutual funds that invest in a specific sector because it models the risk inherent in stock selection. For diversified equity funds, the Treynor Ratio is more suitable because their volatility is strongly tied to the volatility of the benchmark.

Information Ratio

The information ratio is equal to the excess return of fund divided by the standard deviation of the excess returns. It’s essentially a risk-adjusted form of the alpha.

The excess return is the return of the investment beyond that of a benchmark index. By dividing by standard deviation of the excess returns, the Information Ratio effectively eliminates market risk and measures the additional risk taken by fund managers.

The Information Ratio is very useful when judging the performance of an active fund manager, and effectively gives the return per unit of active risk taken by a fund manager.

Omega Ratio

The Sharpe, Sortino and Treynor Ratios both approximate the returns distribution with either the average return or the standard deviation. The standard deviation assumes that the returns have a normal distribution – the classic bell-curve

This isn’t always the case. Investment returns often have fat tails, with greater losses and greater gains than that would be expected from a normal distribution. How do we model this behaviour with a performance benchmark?

One solution, proposed by Shadwick and Keating in 2002 is the Omega Ratio. This divides the returns distribution into two halves – the area below an acceptable return, and the above the acceptable return. The Omega Ratio is simply the former divided by the latter.

This technique neatly captures all of the information in the returns distribution, and models the risk of low probability but high impact losses.