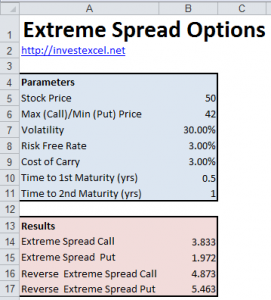

This article introduces extreme spread and reverse extreme spread options, and offers an Excel pricing spreadsheet.

Bermin introduced extreme spread options in 1996. They are suitable for investors who have specific expectations about the direction of the market; they represent good value but offer a high payoff if those expectations are met.

Extreme spread options split the holding time into two continuous parts; the split occurs after the option begins but before maturity. Each part is essentially a lookback period. The payoff is described below

- call: the absolute difference between the highest asset values before and after the split

- put: the absolute difference between the lowest asset values before and after the split

- reverse call: the absolute difference between the lowest asset values before and after the split

- reverse put: absolute difference between the highest asset values before and after the split

These options are similar to looback options and can be priced with the analytical formulas given by Bermin (1996)

Download Excel Spreadsheet to Price Extreme Spread and Reverse Extreme Spread Options